CHAPTER 7: PLANNING, BUILDING AND RUNNING A NETWORK

Every community, approach and broadband life cycle is unique. Some of these “steps” may make sense to come before others in your journey; however, the following can be considered a general progression of a successful community network project.

Are you ready to begin?

- Understand whether your community has a broadband gap.

- Understand whether others are already working to address the broadband gap.

- Understand that this is a marathon, not a sprint. Closing the broadband gap will take a long time and a lot of personal effort.

Seek out existing efforts

- Talk with local elected officials about any existing efforts or with other interested residents.

- Talk with community anchor institutions about any existing efforts.

- Talk with community groups and community leaders about any existing efforts.

Build your team

- Use the convening power of your local government to bring together stakeholder groups for conversation, information sharing and brainstorming.

- Leverage any community anchor institutions, community groups and local businesses that could help involve residents in broadband discussions.

- Identify existing community leaders and trusted members of the community. Seek their advice, keep them informed of progress and when possible recruit them to be involved.

- Establish methods of communication that fit your group and community (email group, Facebook page, Nextdoor, et cetera).

- Create a communications plan that is consistent, transparent and inclusive.

Establish goals

- Establish a problem statement.

- Establish desired outcomes.

- Establish the geographic area you are trying to address.

- Establish the level of service you are seeking.

- Establish the desired level of “future-proofing” — short-term or long-term solution.

- Establish whether you are addressing access, adoption or both.

Assess your community

- Perform a survey to assess granular broadband coverage and levels of service.

- Perform a sentiment analysis to discover potential take rate for future services.

- Approach incumbent local and national providers to discuss future expansion plans.

- Evaluate whether private assets could be leveraged to support better service to residents, including municipally owned fiber, conduit, towers, et cetera.

Understand costs and financing

- Review and set appropriate expectations for total project costs.

- Review and explore current financing options, especially upcoming grant opportunities.

- Lay the groundwork to fund smaller planning expenditures.

Conduct a feasibility study

- Design an RFP that fits your community’s needs and goals.

- Issue the RFP as widely as possible.

- Evaluate RFP results and select a consulting firm.

- Work closely with the selected firm to ensure it is aligned with your community needs and has access to all resources and data to be successful.

- Present the results of the study not only to your team but also community stakeholders and the community as a whole.

Understand legislative and legal barriers

- Familiarize yourself with Michigan laws that will affect the kind of project you’re looking to undertake.

- Familiarize yourself with permitting requirements specific to your project type, such as road permitting for buried lines and pole attachments for aerial.

- Familiarize yourself with environmental permitting requirements appropriate to your area.

Preliminary network architecture planning

Evaluate options

- Involve the community in presenting the results and choosing the path forward. This can be with town hall meetings, individual stakeholder meetings, informal small-group meetings (i.e.: “Broadband and Beer”) or something similar.

- Seek more data if areas are identified that need more information to evaluate, but do not fall prey to analysis paralysis.

- Choose a strategy and begin execution.

Network Building and Engineering Steps

Network engineering steps

- Conduct engineering RFP.

- Determine project management approach and the parties and personnel responsible for such.

- Develop a project schedule, typically provided by engineering contractor.

- Explore subcontractor relationships and policy, which are typically provided by engineering contractor.

- Develop and review mapping, network design and network architecture drawings, typically provided by the engineering contractor.

- Develop project benchmarks.

- Complete permit acquisition and discussions with local road commissions, something typically completed by the engineering contractor.

- Outline expectations of standards and codes to adhere to.

Network construction steps

- Conduct a construction RFP.

- Determine the project management and construction management approach and the parties and personnel responsible for such.

- Select backhaul provider.

- Select drop construction company (if different from network construction company) and approach.

- Build drops, to be completed by network construction and/or drop construction company.

Legal considerations in network construction

- Understand state and local requirements, acts and laws.

- Seek easement approval — public, private and utility pole, typically completed by construction contractor.

- Seek consent from adjacent municipalities, if applicable.

Running a network: Steps to consider when choosing a network operator

- Evaluate network operator via RFP.

- Review help desk considerations and network needs.

- Determine billing and financial management processes.

- Review the contractor’s cybersecurity posture and practices.

- Develop a customer-facing marketing and communications plan.

Evaluate and maintain network

Network Execution Timeline

- Defining your problem statement plus articulating your community’s strategic goals and desired socioeconomic outcomes: 1 month

- Build your team: 2 months

- Establish tactics and timelines: 1 month

- Assess your community: 3 months

- Conduct feasibility study: 3 months

- Evaluate and choose a path: 3 months

- Obtain funding: 12 months

- Build network: 12-24 months

7.A1 Is your Community Ready to Begin?19

From assessing your community; to performing feasibility studies; to the actual design, construction and operation of the network, all of it can be accomplished with external vendors and consulting. It’s important to understand this so you do not become discouraged or intimidated. Undertaking a community broadband effort is a significant project, but it is not one that you and your community team should expect to take on alone. While it is important to have strong community support and leadership in key decisions through the process, it is equally important to recognize the limitations of your own expertise and draw upon outside help when needed. Most community projects will end up with a combination of internal and external resources, depending on the needs of the project and which resources are locally available.

7.A2 Seek out Existing Efforts

The next step is to explore whether any existing broadband efforts are underway in your community. Begin by reaching out to community groups, community anchor institutions and local government. Even if no community team is yet in place, these groups or Merit may be able to connect you with other like-minded individuals from your area who have made inquiries. If no local initiative has been started, you should next contact local community anchor institutions and inform them of your intent.

Community Anchor Institutions

- Township government. Find the contact information for your township on the Michigan Township Association website.

- County government.

- School district.

- State representative. Find your representative using the State of Michigan search.

- Intermediate school district.

- Local library.

7.A3 Build Your Team

Broadband access has the potential to be transformative for individuals, families and businesses across demographic and socioeconomic spectrums. A strong coalition of contributors to your effort is required. However, it is a significant leap from individuals who would like to have broadband access and individuals who are willing to devote their time and resources toward achieving these goals. A robust team of local stakeholders is critical to the success of a broadband project.

The only hard requirements of a team member are desire and time.

Likely members for your group include local elected officials and policymakers, community leaders, both technical and nontechnical local activists, any incumbent providers in your area, representatives from community anchor institutions such as educational facilities and libraries, area chamber of commerce or economic development groups, regional planning groups and volunteers.

A Closer Look: Finding Volunteers and Leaders

Hopefully, inquiries to community groups will yield a few like-minded individuals to help get started, but additional volunteers will increase your ability to succeed. The best way to kick off a volunteer effort will be to host a community broadband meeting. Enabling neighbors to meet you and each other face to face provides a much stronger start, versus simply exchanging emails or messages. When sending invitations to your community meeting, ask for individuals’ permission to add them to an email contact list.

When organizing a community, consider reaching out to potential participants through:

- Facebook groups. Look for existing Facebook groups focused upon your community, and make a post there as the group rules allow.

- Nextdoor. Nextdoor is a private social network focused on neighborhoods. If your neighborhood already has a Nextdoor community, join it and make a post for your broadband effort. If not, consider starting your own Nextdoor community.

- Local newspapers or news websites, if these exist. Consider placing an advertisement or writing an editorial.

- Posting flyers. Flyers with tear tags hung at important community locations can be an effective communication tool.

- Postcard mailings. Another way to reach all households in a community is to mail a postcard to each household. The U.S. Postal Service has a program called Every Door Direct Mail, which provides an economical way to reach all households along a given postal route. The disadvantage of this program is that mail routes don’t necessarily follow municipal boundaries, and mailings may reach beyond your intended scope. To reach residents only in a given municipality, a targeted mailing is most effective but is more expensive. Addresses for all property owners or voters in a given municipality can generally be obtained from the township or county clerk.

Finding Leaders

Besides a robust group of volunteers, broadband efforts are most effective when there is leadership. If you are reading this document, it’s likely that you are well-positioned to provide leadership to such an effort for your own community. If you’re unsure whether you are up to the task, don’t worry.

The only real requirements for leading a community broadband effort are a passion for tackling the problem and a willingness to commit time to doing so.

It will be helpful to find other community members with whom you can share leadership tasks. No magic method or criteria exists for finding and recruiting leaders, but there are two main strategies to keep in mind:

- Delegate and ask for volunteer leaders. It’s important to recognize that you cannot be successful by doing everything yourself, so find tasks or groups of tasks that can be delegated, and ask for volunteers to lead those tasks. If successful, those individuals can be cultivated to provide additional leadership to your effort.

- Targeted recruitment of promising individuals. During the process, it’s likely that individuals may rise to the top in terms of efficacy, enthusiasm and leadership potential. Sometimes people don’t want to raise their own hands and need a nudge to get started, so don’t be afraid to approach these people and ask them to lead or help lead parts of the effort.

Establish Governance

An ideal group structure can be one that is officially sanctioned by the local government, such as a township or county. This group can be a committee, subcommittee, task force or similar. If the local government is not interested in being involved, a citizen’s group can fulfill the same role. In either case, the group should have a leader — chair, president or similar — and if possible a second-in-command to share leadership responsibilities. Having a formal group structure and leadership roles will not only smooth operations but also provide an additional sense of legitimacy to the effort.

7.A4 Establish Goals

Establishing goals can be a more nuanced activity. Your group must answer several questions:

- What is your problem statement?

- What are your community’s strategic goals and desired socioeconomic outcomes?

- What area are you trying to address?

- What level of service are you seeking?

- How important is future-proofing?

- Are you seeking to address broadband access, adoption or both?

The following are some considerations for each question:

- Target area: When considering the target area, it’s important to cast your net widely enough to have enough critical mass but not so widely as to make the goal unachievable. Often, municipal lines can be an easy way to focus efforts (township, village, city, county, et cetera), as can school districts. But almost universally, broadband access challenges do not cleanly follow other boundaries, so your focus area can be whatever makes the most sense for your community.

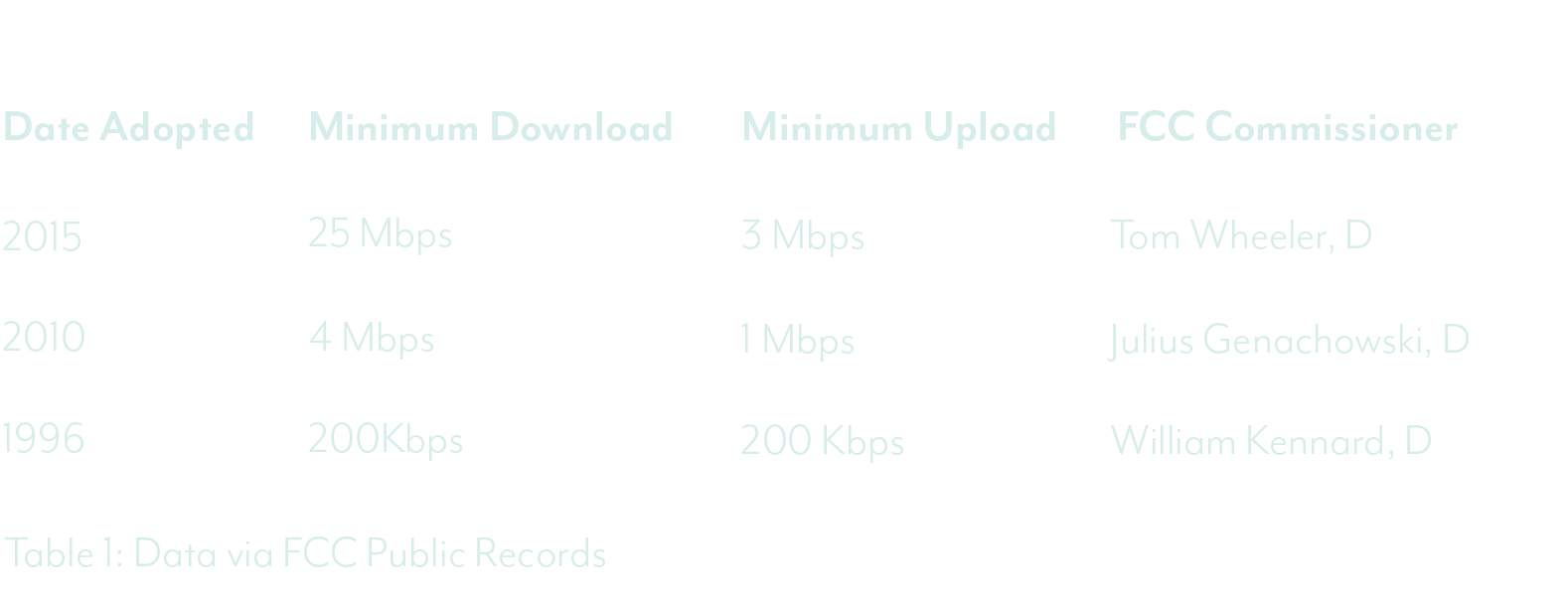

- Speeds: The current FCC definition for broadband is 25 Mbps download and 3 Mbps upload. This definition was established in 2015 and is generally considered to be out of date. In most markets, cable providers have raised their base levels of service to between 100 Mbps and 200 Mbps.

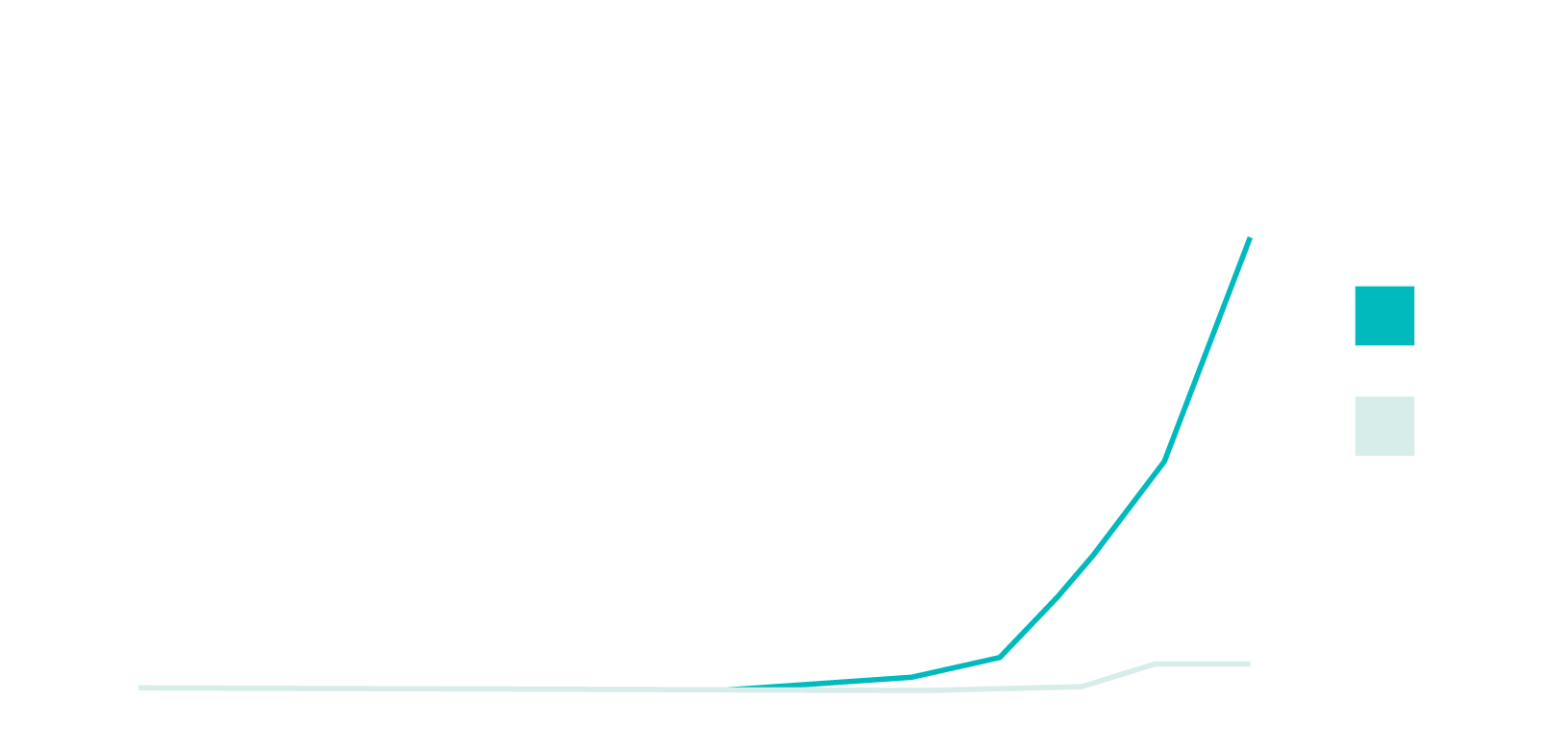

- Future-proofing: As we consider the trajectory of technology, it is also important to consider future demand for broadband. The measures to quantify broadband as “a connection sufficient to support modern networked applications” is a moving target. Ten years ago, streaming video services and video chat were a niche market, while today video accounts for 73% of all internet traffic. Virtual and augmented reality devices are a novelty, while these technologies are projected to command a $200 billion market by 2022. Nielsen’s Law of Internet Bandwidth9 tells us that users’ bandwidth grows at an average rate of 50% year over year. While in some cases it may be expedient to deploy less expensive solutions that solve the problem in the near term, it is important to look to future growth such that your community won’t be working to address the same problem again in five or 10 years. The chart above shows both Nielsen’s Law and the FCC broadband definition over the years.

- Access vs. adoption: Access and adoption have different goals. Access is focused on whether people can access broadband service from their homes, either via a cable running to their home or a wireless signal in the air. Adoption concerns whether people take advantage of the broadband service that is already available to them. Reasons for lack of adoption can be diverse, with one of the most common challenges being economic. Addressing access and adoption are different challenges, so it’s important to understand up front which you are working to address.

7.A5 Assess Your Community

Assessing Broadband Coverage:

Earlier in this framework, we discussed the challenges and inconsistencies with federally cited broadband coverage data. Many funding sources weigh these data reports heavily when awarding grant dollars and subsidies for broadband access.

It’s clear that a better way to quantify broadband coverage is required, which is why Merit has partnered with the Michigan State University Quello Center and M-Lab, one of the world’s largest and most accurate internet measurement platforms, to develop a crowdsourced approach to broadband data collection. Accurate accessibility data can help make a case for private and public funding as well as help define the needs in your community.

Many efforts are underway nationally to address the broadband data challenge:

The Michigan Moonshot deployed a data collection approach that builds on collaborative network organizations (CNOs), often used in citizen science, to leverage (1) networks of stakeholders (i.e., Merit and other participating research and education networks) to manage the sourcing of data from users across the nation, (2) a partnership with academic researchers that allows for data quality control (identifying and correcting problematic data) and sophisticated analyses using multiple sources and forms of data, (3) data collection through a user-friendly app. This allows the flexible collection of data from multiple devices, fixed or mobile.

Expected Benefits of Data Collection and Broadband Deployment

By integrating large national and regional datasets on broadband infrastructures with data on at-home broadband speeds and household-level accessibility, we can advance the ability of policymakers and academics to empirically analyze numerous issues revolving around the internet to

- Contribute to the design of effective policies to address pressing issues such as the homework gap.

- Reduce the financial risks for community economic development decisions with clear indicators of unconnected and otherwise marginalized areas.

- Move beyond an overly simplistic urban- rural divide to compare well-to-do and distressed areas of rural and urban areas and other gradual differences across geographies.

- Catalyze communities to help drive change. A small community investment in this data collection project will help drive granular-level data, an imperative part of the gap in existing datasets available.

- Quantify availability and demand through the creation of crowdsourced broadband assessment tools, demand aggregation maps and community anchor connectivity inventory. Doing so reduces the financial risk for infrastructure investment decisions by providing clear indicators of broadband gaps.

Merit/Quello NTIA Comments – Summer 2018:

Conduct a Sentiment Analysis

While assessment of coverage is a binary activity — coverage either exists at an address or it doesn’t — sentiment analysis is a bit more nuanced. This activity can assess many aspects of how residents feel about broadband service, but the central question is if consumers would subscribe to the type of broadband service you are proposing and at the price you are planning to offer. This enables you to estimate the “take rate,” or the number of households and businesses that would sign up for service. Take rate is a key part of any financial model, and solid data to support this estimate is critical when the data is being used for financial decisions. Take-rate surveys can be conducted by a task force, municipality or outside consultant.

Approach Incumbent Providers

In almost all cases, if building broadband in a given area would yield a rapid enough return on investment to support a private provider, service would already exist. The areas in which broadband service is lacking are generally those with low population densities, challenging terrain or both. However, it is important to build relationships with the incumbent providers in your area, both to understand their current plans as well as future opportunities for partnerships. Resources like Broadband Now and Connect Michigan can provide a list of providers in your area.

(Note: This should not be construed as coverage information)

A Closer Look: Questions for Incumbent Providers:

When contacting providers, several questions should be asked:

Q1: Are you planning to expand coverage in our area, and if so, when and with what level of service?

Plans for expansion are one of the most important things to know. If a provider is planning significant investment in your area, any additional work may be redundant. However, this is generally uncommon. If a provider does communicate an intention to expand in the future, specifics are paramount. In some cases, providers may promise future expansion to dissuade competition when such expansion is not actually forthcoming or not at a level that will meet the goals of the community.

Q2: Can you provide an accurate coverage map for your service in our area or list of serviceable addresses?

Service providers, especially wireline providers, generally have a good understanding of which addresses in a community are “serviceable”— that is, can receive service without a substantial additional investment. Many providers are unwilling to share this information due to competitive concerns. For providers that are interested in partnering with a community, they will sometimes share this information under a nondisclosure agreement.

Q3: Are you interested in working together to explore opportunities for public-private partnerships?

When asking about interest in future partnerships, the answer will almost always be “yes” when no specific action is required of the service provider. Gauging whether a provider is actually a good candidate for public-private partnership will require cultivating a longer-term conversation and relationship, but this is the starting point toward that goal.

Q4: Can you provide an estimate for what it would cost for you to provide service to all households in our area who are currently unserved?

Asking for an estimate of costs to provide service to the rest of the community can be a useful datapoint when exploring public-private partnership. One option for such a partnership is helping an incumbent provider fund expansion of its own infrastructure.

7.A6 Understanding Costs and Financing

Solving the lack of broadband infrastructure is not an inexpensive proposition. After all, if it were cheap and easy, the problem would already have been solved by a private entity. It’s important to understand the potential scope of costs before exploring financing options. It’s also important to note that the individual situations that communities face will vary widely, as will costs.

A Closer Look: Municipal Financing Options:

Coverage data gathering:

Zero to $35,000

As discussed in previous sections, some coverage data already exists from the FCC. However, this data are often lacking, and more granular and accurate data may be desirable. Other entities can provide the tools to conduct this data gathering, but there may be associated costs such as printing and mailing.

Feasibility study/pre-engineering:

$5,000 to $75,000

To get a more specific idea of how much it would cost to build broadband infrastructure in your community, some amount of pre- engineering and financial analysis is necessary— generally referred to as a feasibility study. Depending on the scope of the study, these can range from $5,000 for a basic study to $75,000 for a detailed one.

Engineering/design:

$500 to $5,000 per mile

The significant cost variance here represents the difference not only in projects and engineering firms but also in aerial versus underground projects. Underground projects can have significantly more engineering costs compared with aerial projects.

Mainline construction:

$25,000 to $100,000 per mile

The significant cost variance represents the difference between aerial and underground construction. Underground is more robust and protects cable from storm damage, cars striking utility poles and chewing squirrels, but it is significantly more costly. On the flip side, aerial projects can have significant costs to access the poles and make them ready to receive the fiber.

While most of this funding goes to the construction company for labor, other costs including materials and construction management, permits, rights-of-way acquisition and pole access can be included.

Drop construction and installation:

$500 to $1,500 per home

Cable must be run from the mainline fiber to individual homes, either underground or on utility poles. Then an installer must come into the home to install and activate the customer equipment.

Legal:

Zero to $100,000-plus

Legal costs are highly variable, but plan for not only contract assistance but also compliance with Michigan telecommunication laws, municipal financing and general guidance and advice.

Financial:

Zero to $100,000-plus

Like legal costs, financial costs are highly variable. Activities range from conducting a cost-benefit analysis both to ensure a successful project and to comply with Michigan law, to the significant costs that can come along with a bond issuance.

Project management and administration:

Zero to $100,000-plus

While every project requires management and administration, in some cases these tasks can be undertaken by existing staff resources for no additional hard costs. In other projects, outside firms are hired to complete necessary management. Whenever possible, it is recommended you use project management resources from within the community.

Explore Financing Options

Problems are often simple, even when the solutions are not. In this case, the simple problem is that areas of Michigan with low population densities do not enable fast enough returns on investment to motivate many providers to invest in infrastructure. This leaves these rural areas with slow DSL over aging copper telephone lines, underpowered wireless services or inadequate cellular and satellite services. To solve the problem, significant capital investments are needed to build infrastructure. Whether this is fiber, wireless or a hybrid solution, the root problem is the same: Someone needs to pay for it.

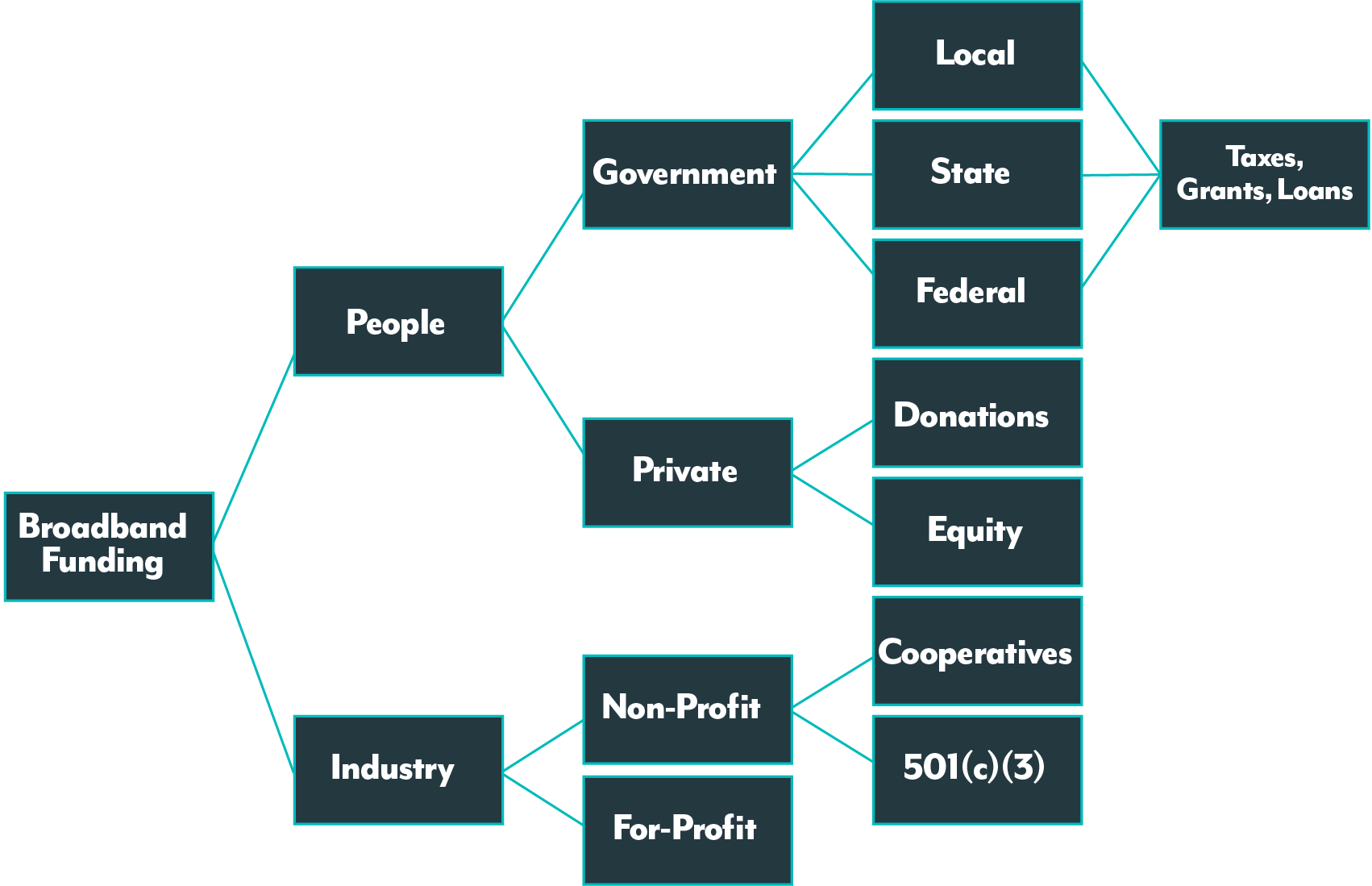

At the end of the day, only three possible sources of funds exist for broadband infrastructure investment:

- Private industry

- The people themselves

- A combination of the two (public-private partnerships)

Private, nonprofit companies are well-positioned to undertake longer returns on investment but often lack sufficient equity to build infrastructure. One exception to this has been electric and telephone cooperatives, which in some cases have sufficient member equity to build broadband infrastructure but generally only for their own members.

The only other option is for some or all of the money to come from the people themselves. This can take a number of forms.

A Closer Look: Municipal Financing Options

If a municipality is willing and able to engage in the financing process, a number of options are available.

General fund: If a municipality or utility has sufficient unencumbered funds in their general fund, this can be used to build broadband infrastructure. Generally, it’s desirable to have a business model where this initial investment is repaid out of future revenue from the broadband service. But a decision can also be made to treat the initial investment as a sunk cost. If repayment is expected, significant due diligence is required to quantify take rates and revenue prospects. The community network in Sebewaing is an example of this model.

Public revenue bond: A municipality or utility can issue a bond that is secured by the future revenue from the broadband buildout. Revenue bonds carry additional risk because their repayment depends on the success of the broadband service, so significant due diligence is required. Public bonds are sold to investors, which can include residents, and can be sold in small increments to encourage community investment. The community network in Fort Collins, Colo., is an example of this model.

General obligation bond: A municipality or utility can issue a general obligation bond, which is backed by the credit and taxing power of the issuing jurisdiction rather than the revenue from a given project. Often the municipality would vote on a new tax, such as a property tax, to fund the bond repayment. The community network in Lyndon Township is an example of this model.

Cost avoidance: A municipality can redirect existing funding used to pay for private network services to build and operate its own network. Longer paybacks may require bonds to be issued and repaid using this funding. This approach is more common for smaller networks that provide municipal services only to start. Examples include Santa Monica, Calif.

A Closer Look: Private Financing Options

These models involve private financing and can be leveraged via a municipal or private effort.

Direct/private loan (debt financing): This model involves a bank or similar private entity providing a short-term loan to launch the network, with the money repaid out of revenue from the network. As with the previously discussed models, due diligence is required to ensure successful future repayment. This model generally has a significant equity requirement— in the range of 20% of the loan amount—which can be a barrier for many projects. The community network in Reedsburg, Wis., is an example of this model.

Private equity: If a third-party investor can be found, this entity or individual can provide the startup capital for the network and own some or all of the network for an agreed-upon period before giving the community a buyback option. An example of this model is MINET in Oregon. Neighborly is a mission-driven startup connecting communities with private equity for broadband.

Loan guarantees: These programs provide a guarantee of repayment on a loan, making loans more accessible in some cases. The challenge with this model is that the project must be able to support repayment of the loan out of revenue, in addition to significant equity requirements. Various national programs provide loan guarantees. These include:

- Rural Utility Service

- Department of Housing and Urban Development 108 Program

- Small Business Administration 504 Loan Program

- New Markets Tax Credits

A Closer Look: Grant Options

A number of state and national grant options are available. Generally, these broadband grant programs are small compared with the amount of funding needed to solve the broadband gap in the areas they cover. As such they are often competitive. Multiple types of grants exist, including general purpose, operating support, planning, management and technical assistance, and equipment grants.

Developing a narrative that answers foundational information about your project and goals will help guide your exploration of potential grant sources, in addition to providing a guiding compass for your broadband initiative as a whole.

The Grant Training Institute suggests these introductory considerations:16

- What is your idea, problem or question?

- Why is your idea significant, important or needed?

- Who will fund your project?

- What is the match between your project and the donor?

- Who will benefit from the grant?

- What is the ultimate purpose or outcome of your project?

- How will the goal be achieved?

- How will the objectives be achieved?

- Who will implement your project?

- How will you know the project succeeded?

- What is the timeline for your grant?

- How much time do you need to distribute the grant funds?

- Where will the funds be directed?

- How will your project results be disseminated?

- How will you sustain the project once the funds cease?

Foundation and private investment financing sources

Local foundations and private companies can also be investigated as potential sources for community network funding. Look for parallels between the mission of these organizations and businesses and those of your community network. Ensuring that your efforts contribute to their mission and objectives is a first step when seeking foundation and private investment resources.

Grants exist for many steps in the community network process, including planning, feasibility, buildout, operations, technology/device procurement and consumer education.

7.A7 Conduct a Feasibility Study

A feasibility study can be conducted at various stages along the journey toward broadband, depending on the scope of study. The most critical part of a feasibility study that requires external contracting help is the pre-engineering effort required to estimate the total cost of a proposed project. An experienced consulting firm will take the requirements of your project, combined with the specifics of your geographic area, and provide an estimate of the total cost of the project. This estimate is necessary when seeking funding.

Feasibility studies can range from $3,000 to more than $100,000, depending on the scope. A reasonably comprehensive study for smaller communities ranges closer to $15,000 to $50,000.

If early funding is not available to your community, the Institute for Local Self Reliance and NEO Partners LLC have created a tool for high-level cost estimates. While this tool can provide estimates that help inform conversations, numbers from this tool are soft and should not be relied on for financing decisions. More information is available on the Community Network Quickstart website.

7.A8 Understand Legislative and Legal Barriers

To effectively explore solutions, it’s important to understand the constraints one is working within. The issues of state legislation, road rights of way, environmental permitting, pole attachments and more should be considered as broadband opportunities are explored.

State Legislation

In March 2002, the Michigan Legislature passed several laws to stimulate the availability of affordable high-speed internet connections such as broadband. Specifically, the Metropolitan Extension Telecommunications Rights-of-Way Oversight Act, PA 48 of 2002, MCL 484.3101 et seq. (the “METRO Act”) created a telecommunication rights-of-way oversight authority and prescribed the powers and duties of municipalities to bring broadband to their communities. The Michigan Telecommunications Act was also amended in 2005 to allow public entities to provide telecommunication services within their boundaries. In short, this legislation creates the following requirements for municipalities that may wish to build their own broadband infrastructure:

- The Michigan Telecommunications Act requires a public entity to issue a request for competitive, sealed bids before it can provide telecommunication services within its boundaries under the METRO Act. The public entity must receive less than three qualified bids from private providers before it can choose to provide its own services.

- The METRO Act requires the municipality to conduct a three-year cost-benefit analysis before it adopts an ordinance or resolution authorizing the municipality to construct broadband facilities.

- The municipality must conduct at least one public hearing before it adopts an ordinance or resolution authorizing the municipality to construct broadband facilities.

- After the public hearing, the public body may adopt a broadband ordinance. This is not required by law but is recommended.

Road Rights of Way

When considering any buried infrastructure, there are two options. Cables are buried in a public right of way or private easement. Private easements are difficult to obtain on a large scale. This model is rare, but not unprecedented (See the B4RN project in the United Kingdom17). It is more common to use existing public rights of way that are controlled by local road commissions. The requirements and costs to access these rights of way can vary significantly based on the permit requirements of the road commission. Although some standardization has been applied to these requirements in PA 97 of 2018, MCL 224.19b (the County Road Law) it is prudent to consult your road commission early in the process if you are considering constructing underground cable.

Environmental Permitting

Michigan has a rich and diverse ecosystem as well as a robust process for protecting that ecosystem. It may be necessary to obtain a permit to cross wetlands, streams, rivers or other water bodies from the Michigan Department of Environment, Great Lakes and Energy (formerly the Michigan Department of Environmental Quality). It is recommended that you contact your local district office to discuss your project and review any permit requirements. A map of Environment, Great Lakes and Energy district offices and contact information can be found at https://www.michigan.gov/documents/deq/wrd-permit-staff_402908_7.pdf. A permit to cross streams and wetlands can take 60-90 days to receive.

Some municipalities may have local wetland permit requirements. Contact your local zoning officer to identify any permit requirements.

Pole Attachments

When constructing any cables that hang in the air on existing utility poles, permission is needed from the pole owner, and various fees will be incurred. Generally, permission to attach to the poles cannot be unreasonably withheld, but it is up to the attacher to pay any associated costs. Any fiber placed on utility poles with electrical wires must adhere to the National Electric Safety Code (NESC). One of the most fundamental safety recommendations by the NESC is the separation of supply space (power distribution) and communications space on utility poles. Other requirements include minimum space between lines, minimum height of the cable above the ground and engineering analysis to ensure poles are strong enough to withstand the weight of additional cables. If a pole doesn’t have room or strength for another cable, and a new pole would be needed to accommodate an additional cable, the attacher would need to pay for that new pole.

7.A9 Evaluate Options: Choose a Path

Once options are explored, the next steps are to evaluate and choose a path to pursue. The goal is to determine which path has the potential to provide the most benefit for the most people in the community at a cost that is achievable.

Examples: Community Broadband Paths

Finally, it is important to choose which model of ownership and operation is best for your community. The four main options are:

Publicly owned, publicly operated

- Advantages: No private parties involved; entire focus is on delivery best service for residents.

- Disadvantages: Unless a municipality has its own utility department, it is difficult to build the staff and expertise required to operate a broadband service.

Publicly owned, privately operated

- Advantages: Maintains community control while allowing an experienced operator to deliver service.

- Disadvantages: Some funds will go to the private operator in the form of their profits, and a private operator must be carefully selected to ensure their interests align with those of the community.

Privately owned, privately operated

- Advantages: Minimizes risk for the community.

- Disadvantages: Community has little control over the network and service; it can be difficult to find a private provider willing to fund the network.

Publicly owned, open access

- Advantages: Enables competition between multiple service providers to the maximum benefit of residents.

- Disadvantages: Especially for smaller communities, it can be difficult to attract more than one service provider to an open access network.

Planning a Network: Conclusion

It is no coincidence that the “plan” section of this framework is comprehensive. This is when the most significant work is required by any community embarking upon the journey to broadband.

After the groundwork is laid, a path chosen and funding secured, the hardest part is completed. This is not to say that building and running a network is trivial. On the contrary, these are challenging tasks. But the critical differentiation is that once funding is secured, professional firms are usually hired to perform the construction and operation of the network. The following sections will equip you to understand what is required to build and run a network such that you can effectively engage with the professional firms that perform these tasks.

Network building can be considered the most significant aspect of a community network. However, it requires the least amount of effort from a community perspective. During the buildout phase, a construction company has been selected, and required designs and permits are complete. This contractor will build the infrastructure of your network according to the planned network architecture and RFP specifications.

The following section contains many considerations. However, it should be consulted as an overview rather than an all-encompassing list.

Network Building Checklist

Network Engineering Steps:

- Conduct engineering RFP.

- Determine project management approach and the parties and personnel responsible for it.

- Develop a project schedule (typically provided by engineering contractor).

- Explore subcontractor relationships and policy (typically provided by engineering contractor).

- Develop and review mapping, network design and network architecture drawings (typically provided by engineering contractor).

- Develop project benchmarks.

- Complete permit acquisition and discussions with local road commissions (typically completed by engineering contractor).

- Outline expectations of standards and codes to adhere to.

Network Construction Steps:

- Conduct construction RFP.

- Determine project management and construction management approach and the parties and personnel responsible for it.

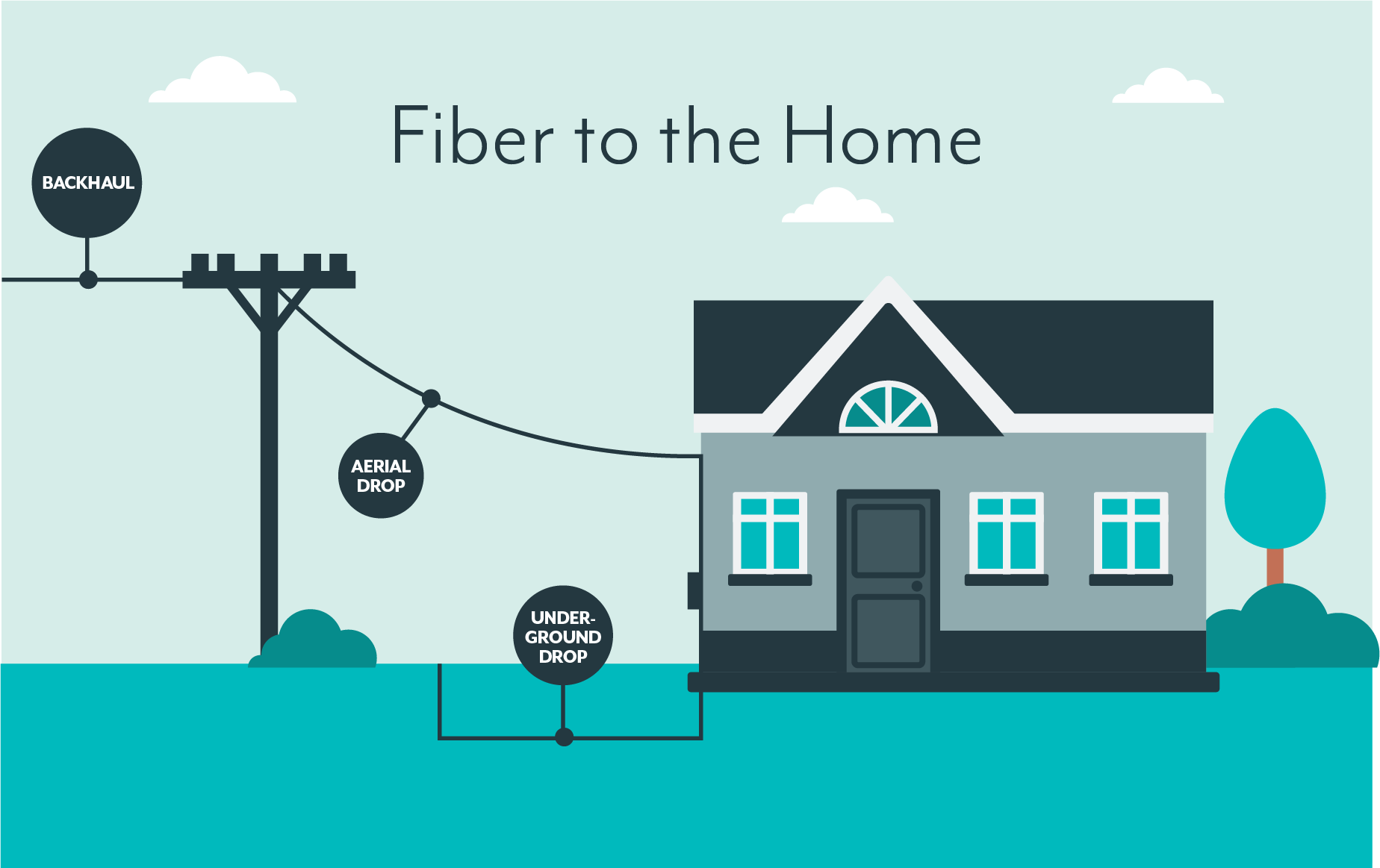

- Select backhaul provider.

- Select drop construction company (if different from network construction company) and approach.

- Build drops (completed by network construction and/or drop construction company).

Legal Considerations in Network Construction:

- Understand state and local requirements, acts and laws.

- Seek easement approval — public, private and utility pole (typically completed by construction contractor).

- Seek consent from adjacent municipalities, if applicable (typically completed by engineering contractor).

7.B1 A Note on Network Architecture and Network Ownership

Not all broadband infrastructure is created equal, and many designs go into a network’s architecture. While the details should be worked out with your consulting or engineering firm, this section will provide you background to understand the design decisions that need to be made. Additionally, a critical strategic decision involves who will own and who will operate the network. Many models encompassing different combinations of public and private partnerships exist, with various advantages and disadvantages for each model.

Network Components

Aerial infrastructure: Aerial infrastructure is hung from utility poles. Communications cables generally need to occupy a specific place on the poles, and there are specific requirements to be allowed to “attach” to poles owned by other parties.

Backbone Network: A backbone is the part of the network infrastructure that interconnects different networks and provides a path to exchange data between these networks. While backbones can be as small as a corporate backbone in an individual data center or as large as a global transoceanic cable, the most common definition is the collection of network links that connect internet peering points.

Where these peering points then branch off into more local route is called “middle mile.”

Backhaul: A general term for the segment of a network between the core and the edge. An example: The connection from a community network hub in a small town to a carrier hotel where it connects to the Internet backbone.

Drop: The connection from the mainline fiber to an individual household in a wired network. The drop can be buried underground of run aerially on utility poles.

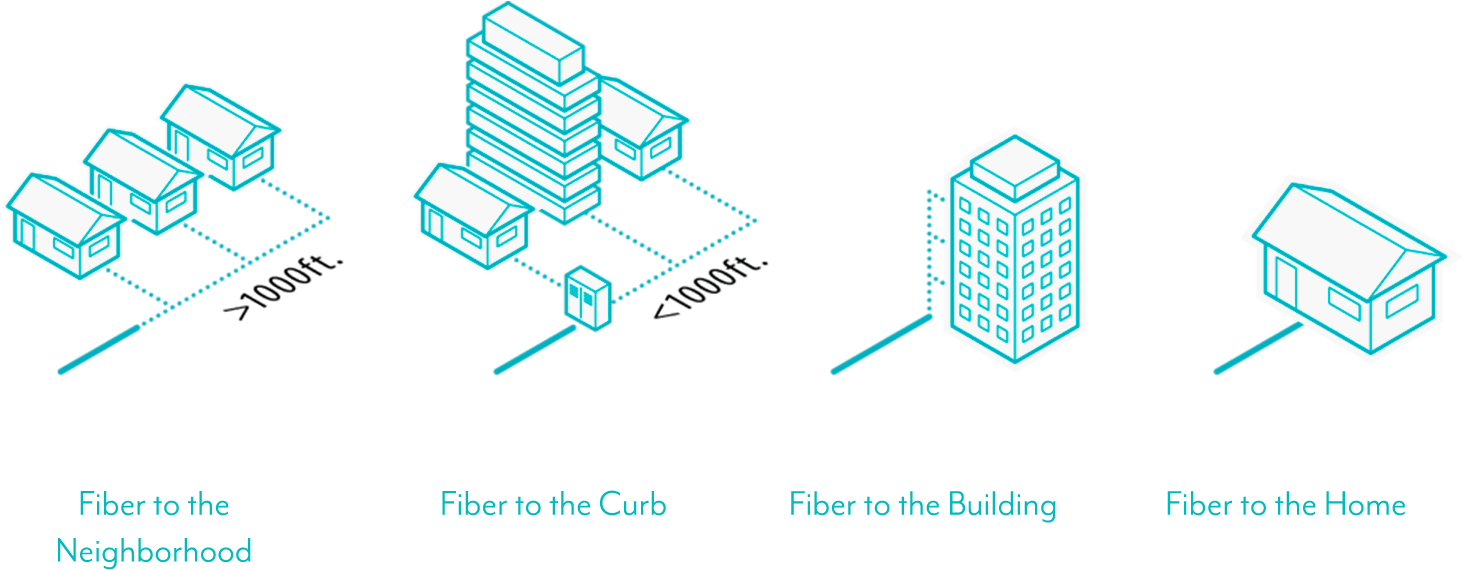

FTTH (Fiber to the home) connection: Companies that sell fiber broadband often describe themselves as “100% fiber networks.” That term is misleading because the FCC recognizes several tiers of fiber broadband service, and most of them switch to another technology, like coaxial cable or even copper telephone lines, at some point between the ISP office and your modem jack. Only fiber to the home is truly 100% fiber.

Underground infrastructure: Underground infrastructure is any cable that is buried. Generally, the most common ways to bury cable are to use plowing or directional boring to place conduit into which the cables are then pulled. Cable can also be directly buried with no conduit.

7.B2 Network Engineering Considerations

Engineering the network is one of the most important steps of the project. This is the phase in which the details of the design will be determined, and the construction company will build the network based on this design. While it is expected that there will be small changes because of real-world factors during construction, it’s important to engineer the design that will best meet your community’s needs.

Network Engineering Steps:

- Conduct engineering RFP.

- Determine project management approach and the parties and personnel responsible for it.

- Develop a project schedule (typically provided by engineering contractor).

- Explore subcontractor relationships and policy (typically provided by engineering contractor).

- Develop and review mapping, network design and network architecture drawings (typically provided by engineering contractor).

- Develop project benchmarks.

- Complete permit acquisition and discussions with local road commissions (typically completed by engineering contractor).

- Outline expectations of standards and codes to adhere to.

Requests for Proposals (RFPs)

As engineering and construction work can exceed $100,000 to $1,000,000-plus; a formal competitive bid, such as a request for proposal (RFP), is recommended for both the engineering and construction of a community network.

A Closer Look: Engineering Request for Proposals

Engineering Request for Proposal

Besides standard RFP requirements, a network engineering RFP might include the following sections:

Project management

The respondents should detail how they plan to handle project management of the design, including key personnel working on the project, expectations regarding meetings with stakeholders and how the engineering firm plans to ensure a high-quality result.

Project schedule

The respondents should provide a detailed timeline for how quickly the project will be completed. Timelines always include variables beyond the control of respondents, but the apparent accuracy of estimates that involve outside variables are an important evaluation criteria. A timeline that is too optimistic is worse than one that is too conservative.

Subcontractors

If the respondent is planning to subcontract any of the work, this should be detailed in the response.

Mapping and design

One of the main deliverables will be construction drawings to be used by the construction company to build the project. A description

of the company’s systems to produce these drawings should be part of the response.

Design benchmarks

Include any specific details the respondent should be aware of — for example, whether active ethernet or a passive optical network is desired, whether all homes and businesses in the community should receive service or just specific areas, desired levels of future-proofing, et cetera.

Engineering proposal

Respondents should explain expected deliverables and reasonable information about their ability to design the requested infrastructure

Permit acquisition

The engineering firm will be critical in acquiring both public permits and private easements and should include its ability to do this in its response. An ongoing relationship and conversation with the local road commission is necessary to ensure the project remains compliant with road permits.

Construction management

Optionally, engineering firms often also supply construction management. This could be included in the engineering RFP as an optional component.

Standards and code references

The RFP should include expectations on standards and codes that the project should adhere to — for example, National Electric Safety Code, ANSI/TIA/EIA Standards, Fiber Optic Test Standards, et cetera.

RFP templates can be found via additional resources through the Michigan Moonshot Appendix.

7.B3 Construction Considerations

The construction company will build the network based on the design from the engineering phase. It’s important to manage the construction to ensure that the end product aligns with the engineering designs.

Network Engineering Steps:

- Conduct construction RFP.

- Determine project management and construction management approach and the parties and personnel responsible for such.

- Select backhaul provider.

- Select drop construction firm (if different from network construction firm) and approach.

- Build drops (completed by network construction and/or drop construction firm).

Construction requests for proposal

Construction of a fiber-optic network of any significant size will quickly reach costs in the millions of dollars. There are multiple ways to approach construction RFPs, but one expedient method is to use the Rural Utility Service Forms 515.21 This is a standard contract and specification used to provide a contracting mechanism for direct buried infrastructure. While these forms were designed to facilitate work done under the Rural Utility Service, this set of documents has become a standard that is well-understood across the industry and can be advantageous versus creating a new contract.

Project management and construction management approach

Any project of this scale requires effective project management to achieve success. This can come from a consulting firm or a local resource if one is available. An ideal situation is to find an effective project manager who lives in the community and is therefore invested in the project, but this may not always be possible.

Construction management is required to provide oversight of the construction company, both for the benefit of the community paying for and eventually benefiting from the fiber but also to ensure the details of any issued permits are being followed. The firm that supplied engineering can generally be effective for construction management, but local resources can also be either found or trained to perform this function.

Selecting a backhaul provider

Backhaul is a general term for the segment of a network between the core and the edge. Essentially, this is the link that connects your community to the outside world. This is an essential link in your network chain — the drops connect each individual home and business, the mainline fiber connects the drops to your central office, and the backhaul connects your central office to the rest of the world. While it is possible to use point-to-point wireless links to provide backhaul, it is more reliable to use a fiber connection if at all possible. A good starting point can be asking for quotes from wholesale providers in Michigan.

Drop-construction contractor selection

Backhaul brings a connection from the outside world to your community, mainline fiber brings the connection down the streets, but the final link to each home is still needed. The “drop” is the connection from the mainline fiber to the individual residence or business. These can be installed either underground or overhead and are generally held to a different engineering and construction standard compared to mainline fiber. For this reason, the drop contractor may be a different entity than the construction contractor.

While it is possible to include drop construction as part of the mainline construction RFP, it generally is not recommended. Some mainline construction companies also handle drop construction. Depending on the construction company your organization selects, you may need to conduct a separate RFP or RFQ (request for quotation) for drop construction.

Building the drops

Homeowner participation is necessary during drop construction. Drops can be constructed via aerial or underground approaches. While aerial drops are less expensive and time-consuming, underground drops are more aesthetically pleasing.

If underground drops are desired or required, this construction entails plowing earth and will disturb homeowners’ lawns. If driveways, sidewalks or landscaping are within the fiber’s path, a deeper trench must be laid via boring techniques to allow the fiber to travel more deeply.

Homeowners often have their own underground infrastructure — such as wells, electric service to outbuildings, sprinkler systems and invisible fences. Because these are not registered in the MISS DIG system, homeowners must generally bear the responsibility of marking the underground barriers themselves.

Notes on Construction Speeds

Underground boring is the slowest method of fiber construction. Boring can be completed at around a maximum of 500 feet per day per crew. After boring, fiber must be pulled through the conduit, which can be completed at about one mile per day per crew.

Plowing can be completed more quickly, but it can only be done in open areas without obstructions like trees and driveways. Additionally, plowing should not occur too close to any trees because severing a tree’s root system can kill it.

Placing fiber is conducted after conduit is placed in the ground by boring or plowing. This can be accomplished by either “pulling” or “blowing” the fiber into the conduit. This phase goes relatively quickly.

Aerial construction is the placement of cables on utility poles. This is generally not done in conduit, but conduit can be used for design reasons. Aerial placement goes quickly compared to underground.

7.B4 Legal Considerations

Legal Considerations in Network Construction:

- Understand state and local requirements, acts and laws.

- Seek easement approval — public, private and utility pole (typically completed by the construction contractor).

- Seek consent from adjacent municipalities, if applicable.

There are multiple legal considerations to explore before and during the network construction phase of your project. Understanding state and local requirements and regulations is the responsibility of all parties; your broadband group or task force and all contractors and consultants are responsible for compliance. Easements from public, private and utility sources must be approved. This approval is typically conducted by the construction contracting firm. Finally, consent from adjacent municipalities, if your network crosses community boundaries, must be sought by the network’s engineering firm.

A Closer Look: Meeting State Requirements: the METRO Act

As outlined above, any entities building broadband service must ensure that they comply with The Michigan Telecommunications Act in addition to local laws and regulations.

- The Act requires a public entity to issue a request for competitive sealed bids before it can provide telecommunication services within its boundaries. The public entity must receive less than three qualified bids from private providers before it can choose to provide its own services.

- The METRO Act requires a municipality to conduct a three-year cost-benefit analysis before it adopts an ordinance or resolution authorizing the municipality to construct broadband facilities.

- The municipality must conduct at least one public hearing before it adopts an ordinance or resolution authorizing the municipality to construct broadband facilities.

- After the public hearing, the public body may adopt a broadband ordinance. This is not required by law but is recommended.

Private Rights of Way

When placing infrastructure on, above or below private property without an existing public right of way, private easement must be granted from the property owner. (An easement is a legal right to use someone else’s land for a particular purpose.) There are variations on how this can take place in a broadband construction project, but the following are some of the common examples. Any specific private easement situations should be confirmed by an attorney.

Private roads

Private roads in Michigan are governed by a private road association. These stipulate provisions that provide private easements for installation of future utilities. In most cases, broadband infrastructure can be considered a utility for the purposes of private road easement, but an attorney should confirm specific situations.

Private easement

When underground infrastructure is installed where no road or other easement currently exists, a new private easement will be required. Often property owners will ask for compensation in exchange for granting easement. In some cases, property owners will grant easement at no cost for public projects that are helping the community. In still other cases, private owners grant easement at no cost in exchange for service that is being run entirely on private properties to reduce costs (see B4RN in the United Kingdom).

Utility pole easement

Utility poles are most commonly installed in public road rights of way, in which case permitting is handled through the local county road commission and is minimal for existing pole infrastructure. However, utility poles can also be installed on private easements. In these instances, case law in Michigan suggests that third parties can install telecommunications cables on existing utility poles without obtaining additional private easement.

Adjacent municipality consent 18

It is possible that the broadband infrastructure built by a municipality may need to cross into adjacent municipalities. If that is the case, the local unit will need to obtain consent from the adjacent municipality before commencing construction. This can be obtained by a resolution of the adjacent municipality’s governing body granting the local unit the authority and consent to install broadband infrastructure within the municipality.

A Closer Look: Shared Municipal Broadband Infrastructure

It is also possible that an adjacent community will want to connect to the broadband infrastructure built by another local government. The Michigan Telecommunication Act provides that “a public entity shall not provide telecommunication services outside its boundaries,” unless two or more public entities jointly request bids. However, this prohibition against providing service outside municipal boundaries may be preempted by Section 706 of the Federal Telecommunications Act of 1996, which directs the FCC to take action to remove barriers to broadband investment and competition.22

There are two primary ways in which intergovernmental telecommunications arrangements can be structured:

- Interlocal agreement: Two municipalities may enter into an interlocal agreement whereby the originating broadband

local unit maintains ownership and responsibility for the infrastructure and provides broadband services to the adjacent municipality for a fee and under certain terms. - Formation of a separate authority: The adjacent municipality buys into the existing broadband system, and the two local units jointly form a new authority to maintain and share responsibility for the system and the provision of services to both jurisdictions. This would require resolutions of both municipalities and other agreements/documents to form and govern the joint authority.

Each municipality will want to consider which option makes the most sense economically, practically and politically in their community.

Conclusion

The building of a regional broadband network is a significant task. However, relying on expert engineering and construction companies should streamline network deployment. Resources such as those included in this document and others from national broadband advocacy groups can provide a foundation for understanding and the process forward.

7.C1 Network Operator Selection

Checklist: Considerations when choosing a network operator

- Evaluate network operator via RFP.

- Review helpdesk considerations and network needs.

- Determine billing and financial management processes.

- Review the contractor’s cybersecurity posture and practices.

- Develop a customer-facing marketing and communications plan.

When selecting a network operator, choosing a turnkey vendor to run your network is highly recommended. Finding a single point of contact to be responsible for customer sign-ups — in home installation, network administration, billing, customer support and more — can often provide the most seamless experience in terms of network operations. A piecemeal approach split between multiple vendors or an insource / outsource model can often be associated with hidden costs and high manpower requirements in terms of vendor management.

Selecting a network operator is a critical step in the project. This is a company with which your community will have a relationship for potentially years or even decades. The network operator should be considered a partner in the project and not just a vendor. As with any critical decision, a formal solicitation and evaluation should be performed. However, since there may be significant variability and unknowns regarding the network operation model, the specificity of an RFP may not be desired. Instead, an RFI can accomplish a similar transparent and competitive procurement model while allowing both parties the flexibility to refine the operational model as conversations progress.

Considerations when choosing a network operator:

- Does the firm have experience scaling a network at the size you’re planning?

- Can the network operator provide strong referrals for similar deployments and ongoing operations?

- Is this vendor currently involved in litigation? Have there been any past judgments against the company? Are there any current liens?

- How have their provider and partner agreements been crafted and vetted?

- Where is the operator’s support located? Strong local support is recommended. Support channels that operate in a different time zone can present challenges.

- Does the organization offer 24/7 services from a network operations center to monitor traffic, outages, alarms and performance issues?

- Is this vendor well-versed and experienced in the technology solutions you plan to deploy on your network?

- Will this network operator provide ongoing management services, such as billing and home installation?

- Will the network operator provide ongoing GIS maps of your network infrastructure?

- How is the network monitored for issues and remediation needs? What are the vendor’s remediation processes?

- What minimum service levels will you negotiate with the provider in regard to latency, packet loss, jitter and others?

- Are the vendor’s goals aligned with the goals of your own community?

Whether you choose to outsource running your network to a turnkey operation, to a number of vendors or to approach operations as a hybrid insource/outsource model, there are additional considerations to note within each functional area.

7.C2 Additional Considerations

Many network operators can also provide network management services. These include billing, home installations, troubleshooting, helpdesk and communications.

A Closer Look: Helpdesk Management Considerations

Some network operators will also provide contract services for customer help and support. Conversely, you may choose to outsource helpdesk support to a firm other than your network operator. A helpdesk can support tactical user issues, incidents and end-user communications. The following are some of the considerations that should be explored with any potential help desk solution.

- Does the network operator offer 24/7 customer service?

- Is their help desk locally operated?

- Do you have access to the network?

- Is the network constantly monitored?

- Can the contractor provide an issue escalation matrix and contact lists?

- Can this operator provide references and recommendations regarding their customer service relationships?

A Closer Look: Billing Systems and Financial Management Considerations:

Similarly to help desk operations, billing systems and the financial management of your network might be controlled within your organization (this is a popular choice for municipalities and public utility networks), or may be outsourced to your network operator or another third party firm. Below are some general questions that should be considered with any of these approaches.

General Financial Management Considerations:

- Does the company follow generally accepted accounting principles (GAAP)?

- Does the company have an annual independent audit performed by an external auditor and received unqualified opinions?

- Has the company filed all required Federal and State tax returns?

- Does the company use outside legal counsel for guidance when necessary?

- Does the company maintain internal controls such as:

- Separation of duties

- Authorization/approvals

- Documentation

- Regular reconciliation

- Physical and cyber security of assets and systems

- Does the company track asset installation in the field?

- Does the company track asset relocate and/or retirement?

Billing System and Financial Management Customer Considerations:

- Does the company create customer invoices on uniquely numbered invoices?

- Is the company’s financial system able to track outstanding customer receivables?

- Does the company regularly collect on unpaid receivables, whether in-house or by use of a third party?

- Does the company have a methodology to give customer credits in the event of a missed deadline or service outage?

A Closer Look: Marketing and Communications Approaches:

Marketing and Communications

Public communications and marketing are critical to building excitement and engagement surrounding community network projects and to attracting residents to purchase connectivity services. You may consider an insource/outsource model for this element of running your network. Your organization, your network operator or a third-party marketing and communications firm can manage this aspect of the network.

The first step in any communications plan is to craft a clear and concise mission statement. A mission statement will share the intentions of your network with customers and will provide your effort an ongoing purpose. A strong mission statement should define your objectives, values and goals. Use this mission as a guiding compass in all tactics and decisions in operating and discussing your network.

While of organizing and planning your network, it is necessary to engage the community. A series of communications focused on building awareness and service intent should be planned. In addition, ongoing communications with existing customers are needed once the network is established to continue customer growth and to advertise new services.

Goals of an awareness-building campaign:

- Make community aware of network plans.

- Build the brand and communicate the values and goals of your network.

- Provide communication platforms to engage with potential customers, dispel any network myths or concerns and build relationships.

Goals of an ongoing campaign once the network is established:

- Continued growth of customer base.

- Advertisement of new services.

- Brand and relationship-building with customers.

Other communications objectives:

- Share information about communications platforms with customers.

- What is your customer service phone number?

- Do you have email addresses or online forms so that users may contact you?

Potential communications vehicles:

- Attend township, city or chamber of commerce meetings. Everyone benefits through a community network. Meeting with local policymakers and influencers can help spread the word about your community network.

- Host a meetup or neighborhood barbeque to discuss your plans, dispel potential myths about community networks and build connections in your community. Meetup.com is a free online platform used to create groups and advertise gatherings of people with a connected interest or cause.

- Distribute flyers in community gathering places, such as libraries, recreation centers and coffee shops. This is a free way to share information about your network.

- Create an email mailing list. Email communications and marketing can be a powerful tool both in the early stages of coalition-building and for ongoing discourse with customers after your network is established.

- Social media is an excellent resource to spread awareness of your network and begin generating enthusiasm with potential customers. An organic campaign can be launched by creating and sharing posts on various channels, such as Facebook and LinkedIn on your network’s account; and on public accounts, such as municipalities, libraries and other public information sources. Request that your network’s champions and partners also share these posts for maximum cost-free exposure. You should also create social media accounts on platforms such as LinkedIn, Twitter and Facebook to provide a two-way communications platform for your customers. Research Facebook groups. Many causes, initiatives and neighborhoods have their own Facebook groups. Some of these may be willing to share your information for free with their member base.Most social media platforms sell ad space at a relatively low cost. These campaigns can be targeted toward the specific demographics of your future customer base, such as age and geographic location. Building a basic advertising campaign through these platforms’ user interfaces is fairly straightforward. However, employing an expert contractor or organization to maximize exposure and conversions is worth considering. Some social media advertising best practices include:

- Be clear on a defined target audience. This will help you craft messages that are the most effective with your potential customers.

- Write copy with the goals of informing, exciting and persuading. Don’t be hesitant to “sound like a commercial.”

- Include images whenever possible. Images garner more attention than text, and many social media algorithms favor posts and ads with image content.

- Include a single “ask” or call to action. Your readers will only take a single action, if any, so be clear in what you are asking them to do. “Click here to learn more.” “Attend our network town hall.” “Sign up today,” etc.

- Monitor the performance of your ads. You’ll notice trends in the platforms, demographics and language that resonates with your audience so that you can craft more effective campaigns and leverage your advertising spends.

- Investigate Nextdoor and other community apps and mailing lists. Organic and paid outreach strategies can mirror those of Facebook and other social media platforms.

- Build a website. Free and low-cost DIY website platforms are prolific. Two of these are WordPress and Square. Both freelancers and creative firms can be hired to create a website for your community network if your group is lacking in those skills. Regardless of whether you insource or outsource your website, here are some suggested considerations:

- Research the websites of your competitors and similar types of networks. Who is their intended audience? What claims are they making about their services? Are there commonalities in language or layout? In what ways might you position your services similarly or differently? Understanding the positioning of similar services can provide a starting foundation for your marketing.

- Design your navigation (architecture first. Using a spreadsheet or grid paper, determine the layout of your main pages and subpages. What content will you be placing on each page and why?

- Most pages should include a headline, explainer copy, a clear call to action and supporting imagery.

- Audience testing, search engine optimization and Google Ads (formerly AdWords) placement are tasks that can be assigned to a freelance web designer or a hosting and maintenance agency.

- Things to consider when outsourcing a website:

- Make sure to review their online portfolio. Does their prior work stand out? Is it easy to navigate?

- What are their charges for designing and revisions? Does the firm charge by the hour or project? If it’s by the hour, include a maximum cost cap in your contract. This can be modified later by addendum, if needed.

- Does your vendor have experience in telecommunications marketing? Are they familiar with the technology, benefits and language?

- How does the firm handle ongoing edits and revisions? During what hours do they provide support?

- Are you collecting any personally identifiable information or sensitive customer data on your website? What are the firm’s security measures? In the event of a data breach, who is contractually responsible?

- How often is your website backed up? Does your hosting firm offer colocation of your data (stored in more than one place)? Do you have access to this data? How often are you provided a backup? If your contracting firm went out of business, how would you transfer your online operations to another vendor?

- Depending on the size and intended profitability of your network, traditional advertising methods can be employed. This could include public radio campaigns, billboards and email marketing. Often, traditional advertising reaches the most individuals in the shortest amount of time.

- Advertising firms can advise on the most effective method of outreach within your network’s budget. Often, these organizations can provide turnkey solutions to research a potential customer base, develop slogans and marketing material and purchase or facilitate media buys.

7.C3 Network Security

Cybersecurity is a growing concern and requirement for any network provider, and community networks may be especially vulnerable because of their smaller size and fewer dedicated IT security staff. The security of your network is the responsibility of all parties involved: your local broadband group, your contractors and vendors and your end-users. Here are a handful of best practices that will bolster the security posture of your operation.

- Equipment selection: When you or your vendors select equipment, perform due diligence to ensure the manufacturer has a trusted history and a commitment to security and privacy.

- Secure your infrastructure: Community networks can be an easy target for attackers, as the potential reward on attacking the network or its subscribers is substantial — especially because there may not be a large budget for security. Ensure that all in-field electronics are properly protected with an access control list (ACL) that permits communication to your internal network only. You or your network operators should deploy complex passwords and centralized logging to further bolster security, and configure a firewall in front of your network’s headquarters to dramatically reduce your threat profile.

- Perform regular security updates: Vulnerabilities will be discovered for your network electronics, and you need to ensure they are properly kept up to date. Although this may mean a small outage while a reboot takes place, this is critical to ensure the security and privacy of your networks and data.

- Ensure payment systems are PCI compliant: Taking credit cards for payment necessitates the use of Payment Card Industry (PCI) certified products and processes. This certification ensures that the highest level of security is given to the storage, transmission and processing of financial data.

- Keep business and customer data securely stored: Both business and customer records are vital to your operation and can contain sensitive and private data. Names, addresses, payment histories and call logs could be considered personally identifiable and need to be viewed only by those with legitimate business need. Company financial data and strategic plans are also prime targets for attack and should be stored centrally with appropriate controls to ensure no data loss.

- Encrypt passwords appropriately: If you or your network operator are assigning out user names and passwords to your customers, ensure that passwords are never stored in cleartext and are hashed using a modern algorithm such as salted SHA256. These hashed passwords should be treated as confidential data.

- Have an incident response plan: It is inevitable that at some point you will be the victim of an attack. Creating a plan beforehand — identifying the people and roles they play during a cyber incident — makes the difference between being able to recover from an attack or being devastated by it.

- Create an acceptable use policy: Have a clear document for your customers that states the kinds of activity that is not accepted, as well as the consequences for performing that activity.

- Know how to address abuse complaints: You will receive notifications that customers on your network are either willingly or unknowingly performing malicious activities such as spamming or DMCA infringements or are launching full-fledged network attacks. Create a process that is clear on how you communicate these complaints and when to disconnect improper customers from your network.

- Have a security assessment performed: A second set of eyes is a great thing to make sure that all your cybersecurity bases are as covered as they can be. Before you begin accepting customers, conduct a comprehensive review of your network posture and security controls so you can be best positioned for success.

Conclusion